Multi-factor Strategy: A Comprehensive Approach to Smarter Investing

Over the years, investment strategies have evolved significantly. From traditional approaches like stock picking and asset allocation to more holistic methodologies such as factor investing.

With increased market complexities, investors need comprehensive strategies to navigate varying market conditions. Today, data-driven decision-making plays a pivotal role in investment strategies, allowing investors to analyze and adjust portfolios based on real-time financial data. One such method is the multi-factor investing strategy, which helps investors optimize returns and manage risk more effectively, by combining more than one factor into a strategy.

What is Multi-factor Investing?

Multi-factor investing is a strategy that combines various investment factors to provide better risk-adjusted returns. These factors have historically been shown to drive market returns. A multi-factor approach provides diversification and hence, reduces the portfolio risk resulting from factor cyclicality.

Some common factors in multi-factor models include:

- Value: Targets stocks trading below their intrinsic value, seeking undervalued opportunities.

- Momentum: Choosing stocks that have demonstrated strong recent performance trends.

- Quality: Investing in companies with strong financial fundamentals.

- Low volatility: Finding stocks with reduced price volatility to mitigate risk.

By combining multiple factors, investors can create portfolios that are better suited to perform across various market environments.

The Science Behind Factor Selection

The financial and economic principles underlying factor selection are rooted in academic research and empirical evidence. Factors like value, quality, and momentum have historically provided excess returns, known as factor premia.

Beyond simply picking factors, a multi-factor strategy leverages smart diversification—the idea that blending multiple factors provides more refined diversification. Unlike a single-factor focus, multi-factor investing spreads risk by ensuring that when one factor underperforms, others may balance the overall portfolio performance.

Multi-factor Approach vs. Single-factor Investing

A key advantage of multi-factor investing is how it balances the limitations of single-factor strategies. Single-factor approaches can expose investors to concentrated risks. For instance, a low-volatility strategy might reduce risk in falling markets but could miss opportunities in bullish environments.

By combining factors, multi-factor strategies help smooth out performance across various market cycles. This is where the concept of the factor cyclicality comes in—different factors perform differently in different market environments. A well-diversified multi-factor portfolio can adapt and provide more consistent returns over time, reducing the chance of large drawdowns that can occur with single-factor investing.

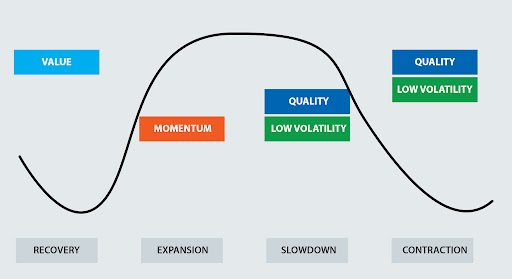

Understanding Factor Performance Across Economic Cycles

The following image illustrates how different factors perform across various stages of the economic cycle. During the recovery phase, the value factor often outperforms, as undervalued stocks benefit from the initial stages of economic growth. Momentum takes center stage during the expansion stage as stocks continue to gain from favorable economic conditions. As the cycle moves into the slowdown phase, the focus shifts towards quality and low volatility, opting for companies with strong fundamentals and low risk. Lastly, in the contraction phase quality and low volatility remain dominant as investors seek safety in financially stable companies and minimize exposure to market fluctuations.

Source: BlackRock

Performance of Multi-factor Investing

The concept of multi-factor investing gained significant attention when Eugene Fama and Kenneth French introduced the Three-Factor Model in 1993, which added size and value factors to the traditional market factor. According to Fama: "The size and value factors, when combined with the market factor, provide a more comprehensive explanation for stock returns than the market factor alone."

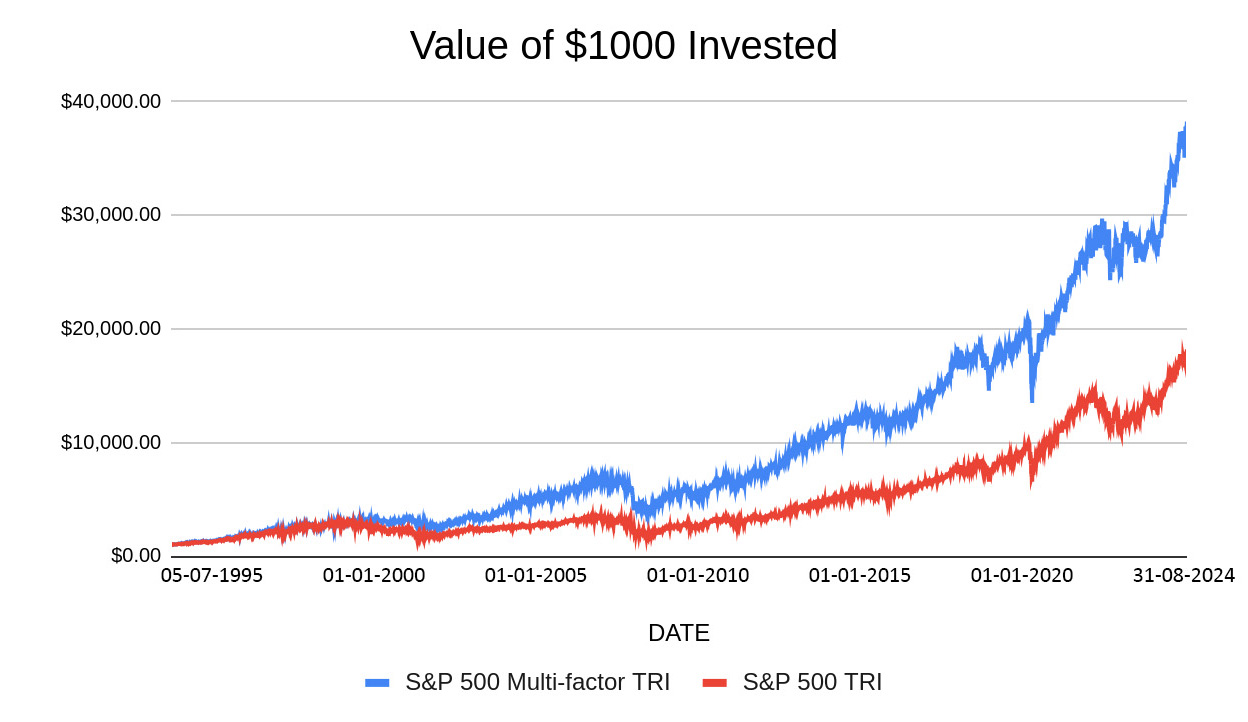

Today, multi-factor investing is regarded as a solid and effective strategy. This can be seen in the graph below where a comparison between S&P 500 Multi-factor Index and S&P 500 Index has been drawn. The data suggests that the multi-factor strategy proves to be a better investment.

Past performance may or may not be sustained in the future and is not an indication of future return. The above is only for illustration purposes and should not be construed as indicative return of offering of NJ Asset Management Private Limited.

Source: Internal research, Bloomberg, NJ’s Smart Beta Platform (in-house proprietary model of NJAMC). This chart depicts the growth in the NAVs of S&P 500 Multi-factor based indices vis-a-vis that of the S&P 500 Index over the period 5th July 1995 to 31st August 2024. All the NAVs are in USD and have not been converted to INR. All the indices have been scaled to $1,000 as of 5th July 1995.

NJ Multi Factor+ Model

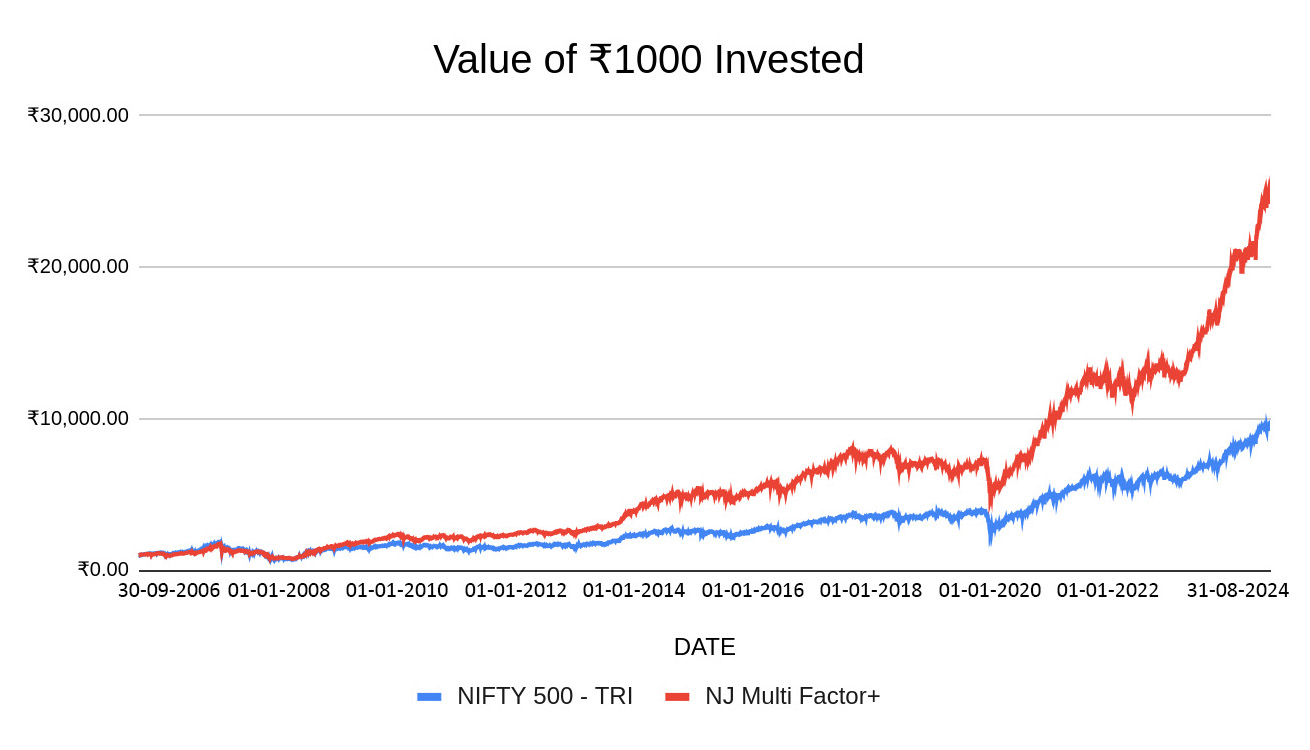

The NJ Multi-Factor+ Model is developed by integrating four single-factor models, with equal allocation. The factors included in the portfolio are Quality, Low Volatility, Value, and Momentum.

The graph highlights a comparative analysis of the NJ Multi Factor+ Model versus the Nifty 500 TRI Index, illustrating the growth trajectory of ₹1000 invested in both portfolios. It reveals that the portfolio leveraging the multi-factor strategy consistently outperforms the benchmark index, showcasing the potential of a multi-factor approach in delivering better returns over time.

Past performance may or may not be sustained in the future and is not an indication of future return. The above is only for illustration purposes and should not be construed as indicative return of offering of NJ Asset Management Private Limited.

Source: Internal research, Bloomberg, CMIE, National Stock Exchange, NJ’s Smart Beta Platform (in-house proprietary model of NJAMC). Calculations are for the period 30th September 2006 to 31st August 2024. NJ Mometum+ is an in-house proprietary methodology developed by NJ Asset Management Private Limited. The methodologies will keep evolving with new insights based on the ongoing research and will be updated accordingly from time to time. All the indices have been scaled to ₹1,000 as of 30th September 2006.

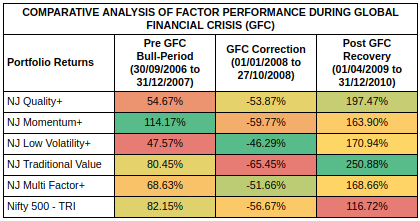

The following table showcases a comparison of different NJ factor models across three periods during the Global Financial Crisis and the COVID-19 pandemic. It suggests that combining more than one factor in an investment strategy can aid in better portfolio performance.

Past performance may or may not be sustained in the future and is not an indication of future return. The above is only for illustration purposes and should not be construed as indicative return of offering of NJ Asset Management Private Limited.

Source: Internal research, CMIE, NJ’s Smart Beta Platform (in-house proprietary model of NJAMC). Calculations are for the specific periods mentioned in the respective column. NJ Quality+, NJ Momentum+, NJ Low Volatility+, NJ Traditional Value, and NJ Multi Factor+ are in-house proprietary methodologies developed by NJ Asset Management Private Limited. The methodologies will keep evolving with new insights based on the ongoing research and will be updated accordingly from time to time. All the indices have been scaled to ₹1,000 as of 30th September 2006.

Conclusion

A multi-factor investing strategy offers a balanced, data-driven approach for investors looking to navigate complex markets. By combining various factors, this strategy offers a smart way to invest across different market conditions.

For long-term investors seeking a more resilient portfolio, multi-factor strategies can provide the diversification and adaptability needed to weather market volatility. Explore this modern investing approach and see if it aligns with your financial future.

FAQs

1) What is a multi-factor investment strategy?

Multi-factor investing integrates multiple factors to design a well-rounded and diversified portfolio.

2) What are the common factors in a multi-factor investing strategy?

A few common factors used in the multi-factor strategy are value, momentum, quality, and low volatility.

3) Are multi-factor strategies suitable for all types of investors?

Multi-factor strategies can be beneficial for both novice and experienced investors. However, the suitability of multi-factor investing depends on your financial goals, risk tolerance, and investment horizon.

Investors are requested to take advice from their financial/ tax advisor before making an investment decision.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

« Previous Next »