Mutual Fund Vs. PMS: Key Differences and Which to Invest In

Mutual Funds (MF) and Portfolio Management Services (PMS) are the two branches in the investment tree. The success of choosing the correct investment path lies in the practice of clearly knowing the difference between mutual funds and PMS. Both investment options allow investors to benefit from the involvement of skilled experts in planning and managing their investments.

What is a Mutual Fund?

Mutual funds pool money from various investors to invest in diversified assets such as equities, bonds, gold, etc. These funds are managed by qualified professionals and fund managers and regulated by the Securities and Exchange Board of India (SEBI).

There are various types of mutual funds including equity mutual funds, debt mutual funds, hybrid mutual funds, index funds, and many more, catering to different investment needs. With features like no entry barriers, high liquidity, and systematic investment plans (SIPs), mutual funds are ideal for individuals looking for a simple and effective way to grow their wealth.

What is a Portfolio Management Service (PMS)?

Portfolio Management Services are customized investment solutions designed for high-net-worth individuals (HNIs). Professional portfolio managers or investment firms manage individual investors' portfolios on their behalf, leveraging their expertise and knowledge.

However, PMS requires a significant capital outlay, with most providers in India mandating a minimum investment of ₹50 lakhs. PMS generally involves higher fees due to the personalized attention and expertise it offers.

Difference Between PMS and MF

Understanding the difference between PMS and mutual funds can help investors align their choices with their financial goals and risk tolerance.

Here’s a clear comparison between PMS and mutual funds based on key criteria:

| Criteria | Mutual Funds (MF | Portfolio Management Services (PMS) |

| Investor Profile | Retail Investors | High-net-worth Individuals (HNIs) |

| Ownership of Assets | Units of the fund | Direct ownership of securities |

| Risk Perception | Moderate | High |

| Capital Requirement | You can start investing through SIP with an amount as low as ₹100. | The minimum investment amount is ₹50 Lakhs. |

| Regulatory Restrictions | Highly Regulated | Comparatively Less Regulated |

Another important criterion to be considered under the difference spectrum is taxation. Let’s understand this through a practical example.

Example Scenario :

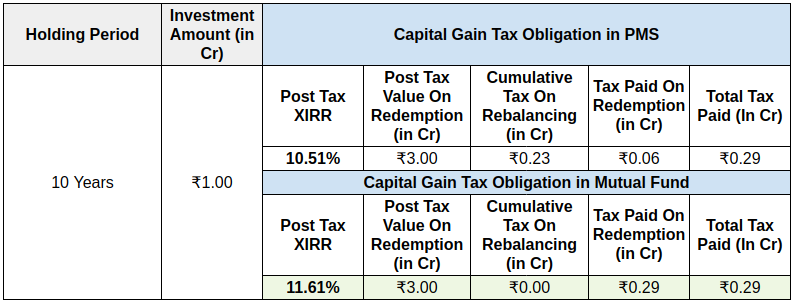

Investor A invests ₹1 crore in PMS, and Investor B invests the same amount of ₹1 crore in a Mutual Fund. For the purpose of this comparison, it is assumed that both PMS and MF managers adopt the same investment strategy, resulting in an identical portfolio composition. Consequently, after 10 years, both portfolios generate identical pre-tax returns with the same annual churn in the portfolio.

Note: The above analysis assumes both PMS and Mutual Fund generate an annualised return of 12.62% p.a. (as per AMFI Best Practices Guidelines Circular No.135/BP/109-A/2023-24, dated September 10, 2024), have Identical churn rates (40% p.a), fees, and expenses, with differences only in tax obligations. All gains realized during portfolio rebalancing and at the time of redemption are taxed as long-term capital gains (LTCG) at a rate of 12.5%. Gains from rebalancing in MFs do not attract taxes unless redeemed, and redemptions occur after 10 years. Past performance may or may not be sustained in the future and is not a guarantee of any future returns.

From the table, it is evident that while the total tax obligation over a 10-year period is identical for both PMS and Mutual Fund investors, the timing of tax payments differs significantly.

PMS investors incur tax liabilities on gains arising from each portfolio churn (realized gains) during the investment period. This generally requires them to pay taxes more frequently whenever a churn occurs. The tax burden becomes heftier for PMS strategies with excessive and very frequent churning, where investors may be required to pay taxes at the much higher Short-Term Capital Gains (STCG) rates.

On the other hand, MF investors are not liable to pay taxes on portfolio churn. Tax obligations arise only when mutual fund units are redeemed. The deferred nature of tax payments allows gains to compound without interruptions, leading to a higher post-tax XIRR compared to PMS.

Factors to Consider Before Investing in MF

The following should be taken into account when investing in mutual funds:

- Investment Objective: Investors have the option to select funds that correspond with their monetary objectives.

- Investment Horizon: Investors need to select the appropriate mutual fund scheme that corresponds with their investment horizon.

- Risk Tolerance: Invest in funds that match your risk tolerance.

Factors to Consider Before Investing in PMS

For those evaluating investment in PMS vs mutual funds, PMS demands a more in-depth assessment:

- Capital Availability: PMS is suitable for investors with a high amount of corpus.

- Risk Appetite: Those who choose PMS should have a moderate to high risk tolerance level.

- Tax Liability: Investors should assess the different PMS strategies with respect to the potential portfolio churn or turnover and its tax implications for the investors.

Is it better to invest in PMS or MF?

The choice between investment in PMS vs mutual funds depends on different factors. Investors should carefully evaluate these factors and decide what's best for them. Use the following pointers as your guide while deciding on where to invest:

- Choose mutual funds if: You have a limited corpus, favor a straightforward investment approach, are comfortable with a moderate level of risk, and are averse to paying frequent taxes.

- Choose PMS if: You have a larger corpus, prefer a tailored investment strategy, are willing to take on higher risk, and are comfortable with paying high and frequent taxes.

It is important to note that while PMSs generally offer more personalization than mutual funds which are standardized for all investors, both mutual funds and PMSs broadly invest in similar assets and are rather different vehicles for long-term wealth creation. Which of the two is ideal for your goals ultimately depends on individual objectives and preferences.

FAQs

1) Which is better, mutual funds or PMS?

There is no one-size-fits-all approach to choosing between PMS vs mutual funds, since both of them are different vehicles for long-term wealth creation. Investors can make a decision based on certain criteria such as investment goal, risk tolerance, corpus amount, etc.

2) What is the difference between PMS and mutual funds?

The difference between PMS and mutual funds can be categorized into different aspects such as structure, aim, customization, and investment approach. Mutual funds pool money into a portfolio, offering low-cost diversification for retail investors. PMS provides personalized portfolios, direct ownership of securities, and active management but requires higher capital.

3) Does PMS offer more flexibility than mutual funds?

Investors can avail themselves of greater flexibility in PMS since it can be tailored according to their goals. In contrast, mutual funds might offer less flexibility, as they may follow pre-defined portfolios and do not allow direct control over the underlying securities.

Investors are requested to take advice from their financial/ tax advisor before making an investment decision.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

« Previous Next »