The Evolution of Factor Investing: The Journey from Alpha to Beta

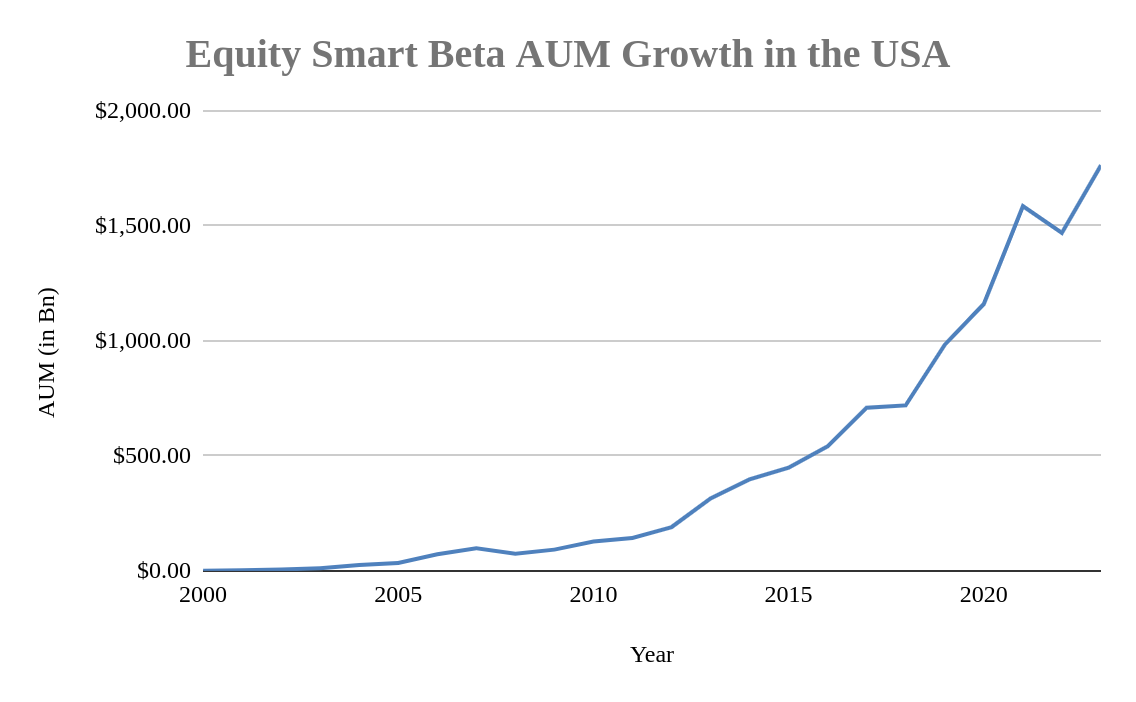

First developed in academic studies in the 1960s, factor investing achieved prominent growth upon its implementation in the investment world. Factor investing is a research-backed strategy that has stood the test of time. Since 2000, Equity Smart Beta Funds in the US have grown at a compounded annual growth rate (CAGR) of 39.52%, as reported by Bloomberg. But how did this concept, born in academia, become a cornerstone of modern investment portfolios?

Source: Bloomberg Intelligence. Data as on 31st December 2023. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

What is Factor Investing?

Factor investing is an investment strategy that adopts a framework of proven principles or factors to achieve higher risk-adjusted returns. The premium returns can be attributed to various factors, such as quality, momentum, value, low volatility, etc.

Factor investing is like crafting a recipe for successful investing. Imagine cooking a dish, but instead of relying on gut feeling, a precise, proven set of ingredients that have been tested and refined over time are used. These ingredients—or factors—work together to deliver a flavorful outcome: higher risk-adjusted returns.

In simple terms, factor-based investing removes human biases from the selection of securities in a portfolio by relying on backtested and data-driven inferences that are proven to guide market performance. Active and passive investing often feel like two competing extremes, but factor investing offers a happy medium.

History of Factor Investing

In the early days of investing, intuition, gut instincts, and a touch of luck dominated the markets. Fund managers relied heavily on their "alpha", their ability to outperform the market using personal judgment and unique strategies. But as the field evolved, a quiet revolution began in academia, transforming investing from an art into a science.

The Foundations in Academics (1960s-1980s)

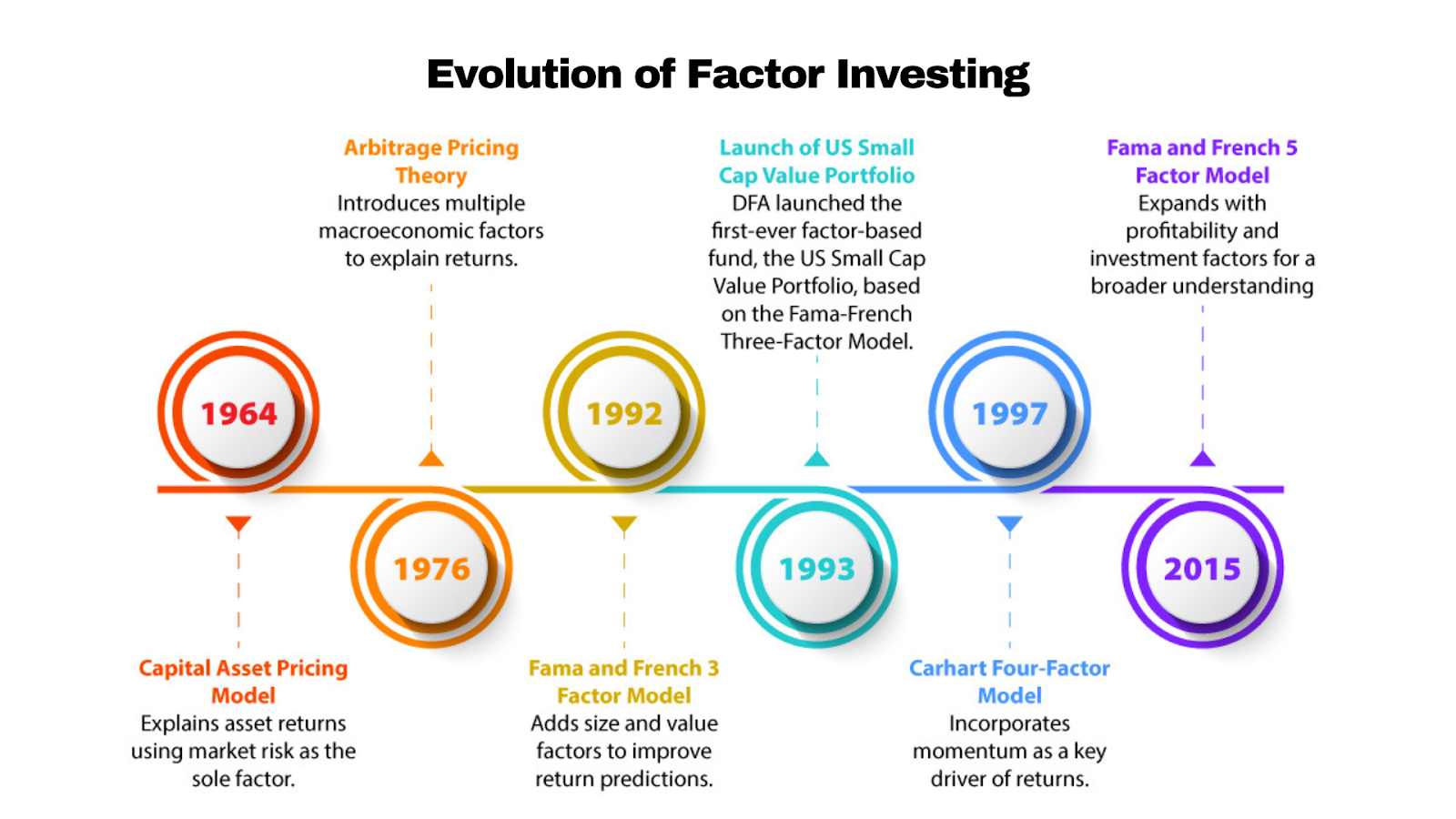

Origins of Factor Investing: The Quiet Academic Revolution of 1960s

It all began in the 1960s with the development of the Capital Asset Pricing Model (CAPM), from where factor investing got its roots. By providing a framework for explaining market returns, CAPM was like the first map in an unexplored land. The CAPM states that the sole factor that accounts for a security’s risk and return is market risk or “beta”, a measure of the movement of asset prices in relation to the market. Think of beta as the movement of a boat on water—as the water level (the market) moves, the boat (the stock) rises or falls with it.

Shift Beyond Beta in the CAPM Era

However, cracks soon appeared in this theory characterized by numerous assumptions. Researchers noticed anomalies—portfolios having companies with specific factors like small-cap stocks or value stocks seemed to provide higher risk-adjusted returns which CAPM failed to explain, bounded by its limitations.

Later, Stephen Ross in 1976 with his Arbitrage Pricing Theory (APT), introduced the idea that multiple factors—not just market beta—could explain returns. It was as if Ross had added more layers to the map, showing hidden trails and shortcuts that CAPM had missed.

The Evolution into Practice (1990s-2000s)

The Practice of Factors: Bridging Theory and the Real World

In 1992, Nobel Laureates Eugene Fama and Kenneth French extended the CAPM framework by adding two more factors—value and size. Their pioneering "Three-Factor Model" became the foundation of the first ever factor-based fund, US Small Cap Value Portfolio,launched by Dimensional Fund Advisors (DFA) in 1993.

These two factors, size and value, transformed the way investing strategies were perceived and became key drivers of outperformance.

- Size Factor: Investing in smaller companies, which tend to grow faster than larger, more established ones, is referred to as the size factor. Consider purchasing a startup as opposed to a large multinational company; startups typically have more space for expansion, but they also carry greater risk. Fama and French demonstrated this additional advantage of investing in small-cap companies, referred to as the “Size Premium”.

- Value Factor: Purchasing stocks that appear cheaper or undervalued in relation to their earnings and growth prospects is known as the value factor. Finding hidden gems, or businesses that are undervalued, is the goal of value investing. It's like recognizing a diamond in the rough. Fama and French’s High-Minus-Low (HML) factor reiterated this “Value Premium” earned by investing in such undervalued stocks.

Later in 1997, Mark Carhart introduced the Carhart Four-Factor Model, expanding on the Fama-French framework by adding the momentum factor. Momentum is like a snowball rolling downhill—the more it picks up speed, the more momentum it gains. In order to take advantage of this "continuation effect," the momentum factor looks for stocks exhibiting strong performance in the past 6 to 12 months.

Transforming Investment Strategies with the Emergence of Factors

The 1990s saw the incorporation of academic studies into practical investing. Asset managers began developing factor-based methods that enhanced data analysis and portfolio construction by utilizing technical innovations such as smart beta. Traditionally, “beta” referred to the market’s risk. But smart beta flipped the narrative. Instead of treating beta as a passive benchmark, it became an active tool.

During this time, other factors like quality and low volatility were discovered. These factors didn’t just describe markets—they started shaping portfolios.

- Quality refers to investing in companies with strong and stable earnings, solid balance sheets, low debt, and good management practices. Selecting businesses that have a solid moat, or competitive advantage, is what quality is all about.

- Low volatility refers to stocks that experience smaller price swings compared to the broader market, helping reduce risk. Low-volatility stocks provide a more stable ride, so consider it like picking a smooth and calm route for your road trip.

The Mainstreaming of Factor Investing (2010s)

New Dimensions: Fama, French, and Beyond

After a 2009 study by Ang, Goetzmann, and Schaefer* found that factor exposures, and not managerial abilities, were responsible for over 70% of Norway's sovereign wealth fund's (NBIM) active returns since 1998, factor investing gained more prominence. This was a wake-up call: factors were driving returns, not intuition.

An important step forward in the real-world implementation of factor-based investing was made in 2015 when Fama and French introduced their five-factor model, incorporating profitability and investment as new factors.

Factor Investing for All: The ETF Revolution

Fueled by academic studies confirming factor performance, the rise of ETFs in the 2000s democratized factor investing. What was once the domain of institutional investors became accessible to individuals. ETFs tracking factors like momentum, quality, and low volatility emerged. It was as if investing’s secret sauce was now available in ready-to-use packets.

This period also saw the development of multifactor models. Multifactor models assign weights to different factors according to their relative importance in the portfolios. No single factor can meet all investment expectations, and thus, adopting and developing a multifactor model is essential for balancing portfolio risk and return effectively.

The Buffet Revelation, Hidden Factors of Success

Frazzini, Kabiller, and Pederson demonstrated that one of the prime drivers of the success of the investing legend Warren Buffett was his disciplined exposure to certain investment factors. “Buffett’s alpha” could largely be attributed to exposure to value, quality, and low-risk factors. His investment strategy aligned so closely with these proven factors that it could be seen as an application of factor investing itself. “Buffett’s alpha” had, in essence, become beta.

From Alpha to Beta: The Transformation

Factor investing is a journey of traversing from alpha to beta. What used to be considered a fund manager's unique skill has now been standardized into systematic, repeatable strategies. Factors like quality, value, momentum, and low volatility have been elevated from intuition to the forefront of portfolio development by decades of research.

The Road Ahead: Factor Investing in the Technology Era

Factor investing has advanced significantly from its modest origins in academic papers with the market-centric perspective of CAPM to its current evolution into a multifactor perspective, with variants of the Fama-French model playing a major role.

The transformation continues as we look towards the future. New factors are being discovered with developments in AI and machine learning. ESG (Environmental, Social, and Governance) factors are becoming more and more important as investors look for both responsibility and profits. Factor investing is no longer just about past performance; it’s about shaping the future of finance.

FAQs

1) What is factor investing?

Factor investing refers to investing based on specific factors like quality or value, which are proven to drive asset returns.

2) Who invented factor investing?

The CAPM, introduced in the 1960s, attributed asset returns to a single market factor, laying the groundwork for further research. This led to the 1976 Arbitrage Pricing Theory (APT) by Stephen Ross, which introduced the idea that multiple factors drive returns. Fama and French advanced the theory in 1992 with their Three-Factor Model, making factor prevalent among investment managers.

3) How is factor investing different from traditional investing?

In traditional investing, fund managers or investors make investment decisions based on their individual judgments, which are characterized by various biases. In contrast, in factor investing, decisions are based on certain factors.

Investors are requested to take advice from their financial/ tax advisor before making an investment decision.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

*Guide to factor investing in equity markets. n.d. Web. 19 Dec. 2024.

**Andrea Frazzini, David G. Kabiller, and Lasse Heje Pedersen."Buffett's Alpha"

« Previous Next »