Momentum Factor Investing: Key to Stay Ahead in the Market

Envision yourself surfing, riding a strong wave, and using its energy to propel yourself forward quickly and effectively. Imagine a particular stock as that wave, and use momentum investing as your surfboard to stay ahead of the curve by riding the patterns in the market.

Momentum factor investing seeks to leverage the tendency of the stock that has recently performed well to maintain its strong performance going forward. Like surfing, the key is timing, catching trends at the right moment to ride their momentum. Momentum investing has become more prevalent among investors as a means of staying competitive by capitalizing on the high momentum in stock prices.

Momentum factor investing has been supported by prominent investors and researchers. In their 1993 paper, Narasimhan Jegadeesh and Sheridan Titman provided strong evidence that momentum strategies can yield superior returns. Their study, “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency”, demonstrated that stocks tend to possess momentum characteristics. Additionally, the paper highlights that successfully applying a momentum strategy generates substantial returns over a 3- to 12-month timeframe.

The Science Behind Momentum: How Does It Work?

Momentum factor investing works on a very basic principle: stocks that have recently performed well tend to keep performing well. In technical terms, it is a time-based strategy where investors buy stocks with rising prices and sell those with declining trends.

But how does the momentum factor strategy differ from traditional strategies, such as contrarian strategy, that follows the “buy low and sell high” approach? The answer lies in its approach. Unlike the traditional approach, the momentum factor follows the “buy high and sell higher” approach.

Contrarian investors go against the market trend and seek out undervalued stocks, hoping the market will realize its true potential. On the other hand, momentum investors hop on to the existing trends rather than waiting for the reversals.

While going against the Efficient Market Hypothesis (EMH), the momentum factor has found its way into the markets. Eugene Fama, a pioneer of modern financial theory, once remarked, “Momentum is the biggest embarrassment to the theory of efficient markets,”* emphasizing how momentum contradicts the efficient market hypothesis but continues to perform.

In this form of factor investing, the key is to "go with the flow," assuming that winners will keep winning, and losers will continue to lag. This method of factor-based investing offers a dynamic alternative to more passive strategies, providing an opportunity to capitalize on price movements.

Why Momentum Matters: Tapping into Market Psychology

Momentum factor investing can be directly associated with behavioral finance. Behavioral finance explains how human emotions, such as greed, fear, and FOMO, propel stock prices above their true values. A single piece of good news can lead to a stock’s price to surge in less than an hour. Momentum investors leverage these emotional tendencies.

For example, take herd mentality-investors lean towards following the crowd. If they see a stock’s price increasing, they will pile in, further driving the stock price up. This creates a self-reinforcing loop, which momentum factor investing exploits. This is why moment as a factor works so effectively, it tends to capitalize on market inefficiencies that arise from investor's emotionally driven decisions and broad market sentiments.

Performance of Momentum Factor Investing

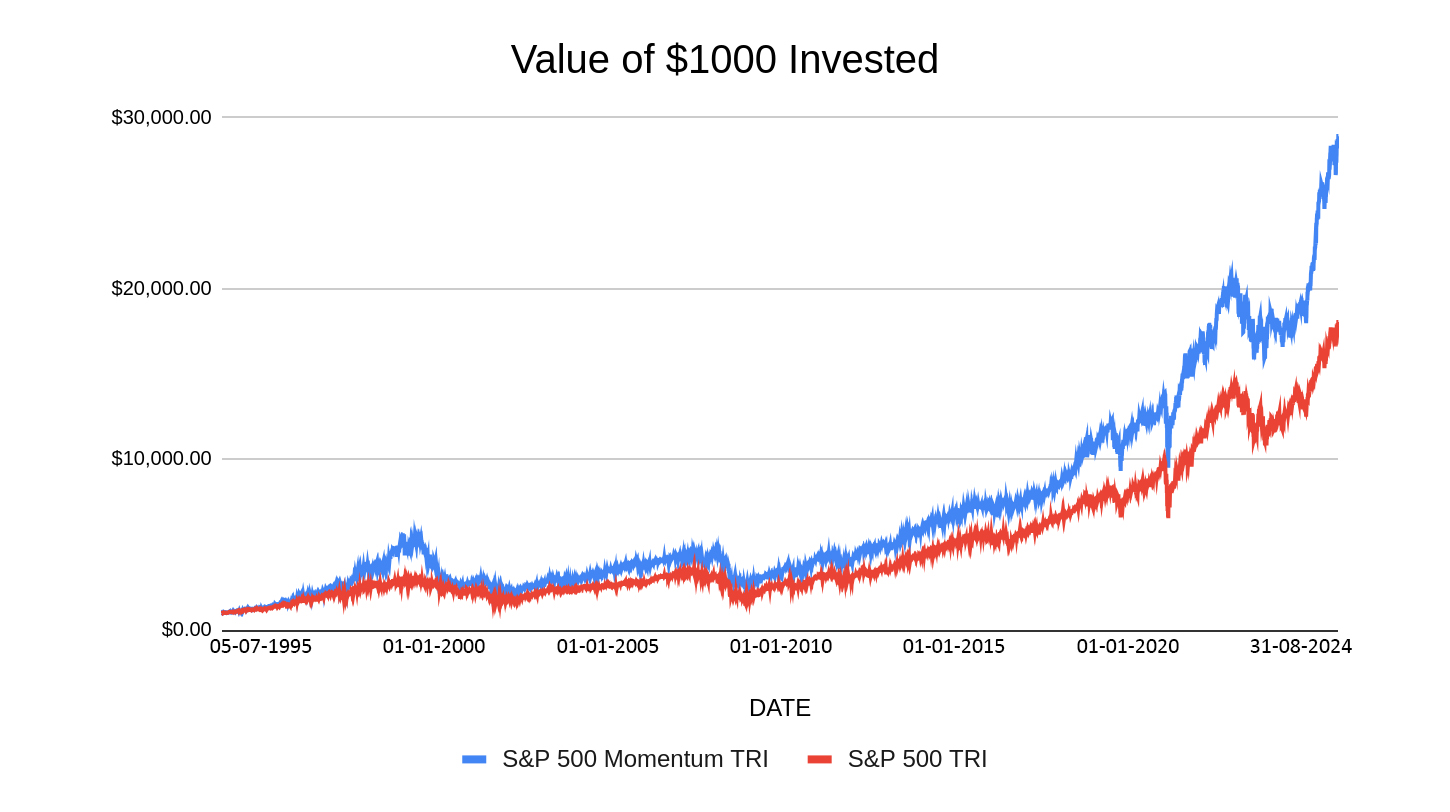

Historically, momentum factor investing has generated excessive returns in the US. This can be seen in the graph below which compares the performance of the S&P 500 Momentum Index with the S&P 500 Index.

Past performance may or may not be sustained in future and is not an indication of future return. The above is only for illustration purposes and should not be construed as indicative return of offering of NJ Asset Management Private Limited.

Source: Internal research, Bloomberg, NJ’s Smart Beta Platform (in-house proprietary model of NJAMC). This chart depicts the growth in the NAVs of S&P 500 Momentum factor based indices vis-a-vis that of the S&P 500 Index over the period 5th July 1995 to 31st August 2024. All the NAVs are in USD and have not been converted to INR. All the indices have been scaled to $1,000 as of 5th July 1995.

Momentum isn't just a U.S. centric phenomenon. In their 2013 research, Cliff Asness, Tobias Moskowitz, and Lasse Heje Pedersen extended the understanding of momentum with their study “Value and Momentum Everywhere”*. They found that momentum as a factor works across different asset classes and geographies, confirming that the strategy is robust and not limited to specific markets.

How to Measure Momentum Factor

To effectively implement a momentum factor strategy in the portfolio, it is crucial to understand how to calculate momentum. Momentum is typically measured by looking at past price performance over a certain period, such as 3 months, or 6 months.

The 3-month momentum factor measures the stock performance for the recent 3-month period by simply calculating the percentage price change over this period. This provides an overview of the stock's performance in the past quarter.

While the calculation for the 6-month momentum factor is the same, this provides a comparatively longer view, assessing how the stock has performed over the previous 6 months. Investors who wish to avoid short-term fluctuations and focus on mid-term momentum can use the 6-month momentum measure.

NJ Momentum+ Model

The NJ Momentum+ Model is designed to capitalize on the price movement of stocks by leveraging both short-term and long-term momentum trends. It ranks the stocks based on their combined score of short-term and long-term momentum. The model chooses the Top 100 stocks with the highest combined score from the Top 500 stocks by free-float market cap universe and constructs an equal weighting model.

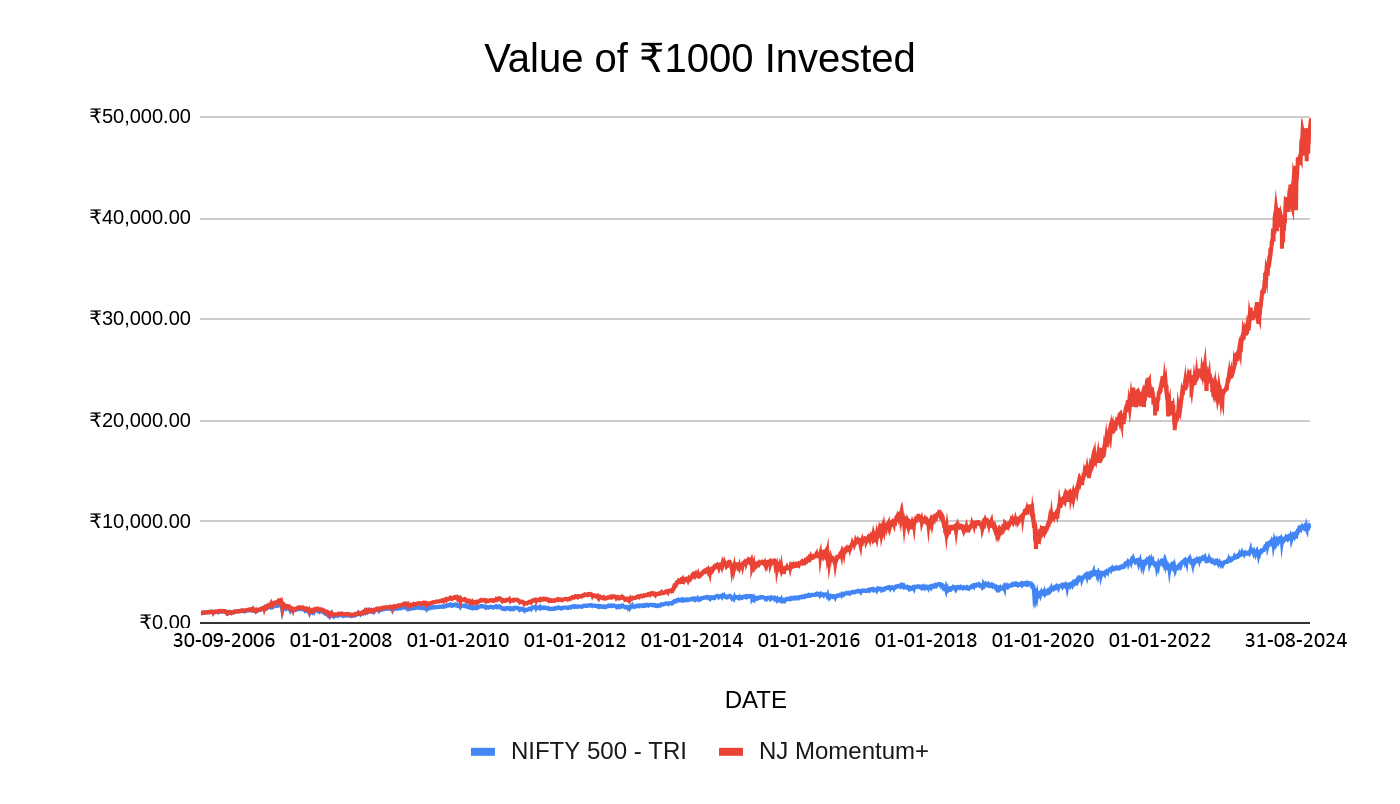

The following graph contrasts the performance of the NJ Momentum+ Model with the Nifty 500 TRI Index. It represents the growth of the value of ₹1000 invested in both portfolios. The graph showcases that investment in a portfolio backed by a momentum-based strategy would have generated better returns over the period.

Past performance may or may not be sustained in future and is not an indication of future return. The above is only for illustration purposes and should not be construed as indicative return of offering of NJ Asset Management Private Limited.

Source: Internal research, Bloomberg, CMIE, National Stock Exchange, NJ’s Smart Beta Platform (in-house proprietary model of NJAMC). Calculations are for the period 30th September 2006 to 31st August 2024. NJ Momentum+ is an in-house proprietary methodologies developed by NJ Asset Management Private Limited. The methodologies will keep evolving with new insight based on the ongoing research and will be updated accordingly from time to time. All the indices have been scaled to ₹1,000 as of 30th September 2006.

Conclusion

Investors willing to embrace market volatility and capitalize on the existing trends can take advantage of the momentum factor. While not without risk, the benefits of momentum factor investing are clear: the potential to take advantage of market inefficiencies, identify trends, and outperform competitors in ever-changing markets.

The rise in momentum factor strategy has provided investors with various tools to incorporate momentum factor into their portfolios. By riding the waves of market trends, momentum investors can gain an edge in the ever-evolving world of finance.

FAQs

1. What is the momentum factor?

A momentum factor refers to investing in stocks that are the “recent winners” i.e. stocks that have performed well in the recent past. Momentum factor investing is a key component of factor-based investing, where investors seek to exploit systematic patterns in the market.

2. How to calculate the momentum factor?

The momentum factor is typically calculated by comparing a stock’s recent price performance over a specific period, such as 3 months, 6 months, or 12 months.

3. What risk is associated with momentum factor investing?

The market behavior is uncertain and can lead to abrupt ups and downs leading to changes in investor behavior. Hence, market reversals are a key risk related to momentum strategy, as stocks that have performed well might experience a sudden change in their trend.

Investors are requested to take advice from their financial/ tax advisor before making an investment decision.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

*(PDF) returns to buying winners and selling losers: Implications for Stock Market Efficiency. n.d. Web. 19 Sept. 2024.

*“Value and Momentum Everywhere: Factors, Monthly.” AQR Capital Management, www.aqr.com/Insights/Datasets/Value-and-Momentum-Everywhere-Factors-Monthly. Accessed 19 Sept. 2024.

« Previous Next »