Smart Beta Investing: Key Benefits and Strategies

Investors have long sought ways to achieve better returns while managing risk in their portfolios. Earlier, this involved choosing between active investment and passive investment strategy. These investment strategies have their own share of advantages and disadvantages. Building on these strategies, a relatively new methodology, known as Smart Beta investing, has gained popularity, especially in the Indian market, as a compelling alternative. But what is Smart Beta investing, and how can investors benefit from it?

Smart Beta investing seeks to blend the best of both worlds - offering the diversification of passive investing with the potential for outperformance associated with active strategies. By combining different aspects of active investing and passive investing, Smart Beta investing provides a nuanced and systematic approach.

Understanding Smart Beta Investing

Smart Beta investing is similar to filling your plate with meticulously cooked meals. You adhere to a predetermined set of standards rather than choosing foods merely because they're well-liked (like passive investing) or depending only on a chef's preference (like active investing).

Smart Beta investing focuses on selecting healthy dishes (quality), that taste great (momentum), or offer the best value for your money (value). This process is based on certain factors that have historically proven to outperform the market. By doing this, Smart Beta strategies aim to beat traditional index funds in terms of risk-adjusted returns.

Key Benefits of Smart Beta Strategy

-

Diversification

One of the primary benefits of Smart Beta investing is enhanced diversification. With a multifactor approach, the influence of any one factor can be reduced, ensuring diversification which helps to create a portfolio that is more resilient and balanced. The Smart Beta technique distributes risk among different stocks.

-

Rule-based approach

The rule-based approach is the foundation of the Smart Beta strategy. By following predefined rules, the investment method becomes systematic and less prone to the influence of emotional and subjective biases. A disciplined process ensures that investment decisions are consistent and aligned with the objectives.

-

Potential for higher risk-adjusted returns

The potential of Smart Beta strategies to generate better risk-adjusted returns is an important benefit. Smart Beta funds can help investors capture specific market inefficiencies, leading to returns that outperform standard benchmarks, over time.

-

Transparency

As the Smart Beta investing strategy is rule-based, the methodology is well-documented and disciplined. This allows the investors to have a clear understanding of how the portfolio is constructed and what factors are driving returns.

Core Strategies of Smart Beta Investment

-

Value

Value factor focuses on stocks that appear to be undervalued compared to their intrinsic value. This approach seeks to capitalize on the tendency of undervalued stocks to outperform over time as the market corrects their prices.

-

Quality

Quality factor prioritizes companies that have strong and healthy financials. By investing in high-quality companies, this strategy aims to minimize risk while still achieving solid returns. Further, quality companies are more likely to withstand economic downturns and deliver steady returns over time.

-

Low Volatility

Low volatility factor investing targets stocks that portray less price fluctuations over time. These stocks tend to perform better during market turbulence, providing a cushion against sharp declines.

-

Momentum

Momentum strategies invest in stocks that have exhibited strong recent performance, based on the principle that these stocks will perform well in the near future. Investors aim to ride the trends and generate superior returns.

Selecting Smart Beta Strategy

There is no single Smart Beta investment strategy that would be suitable for all investors. Particulars such as investment objectives, risk tolerance, and market outlook play a role in selecting the best Smart Beta strategy. For example, If someone prioritizes stability and capital preservation, Low Volatility could be a better fit. Similarly, momentum strategies are well-suited for investors looking to capitalize on short-term market trends but have a high-risk tolerance.

Growth of Smart Beta Investing

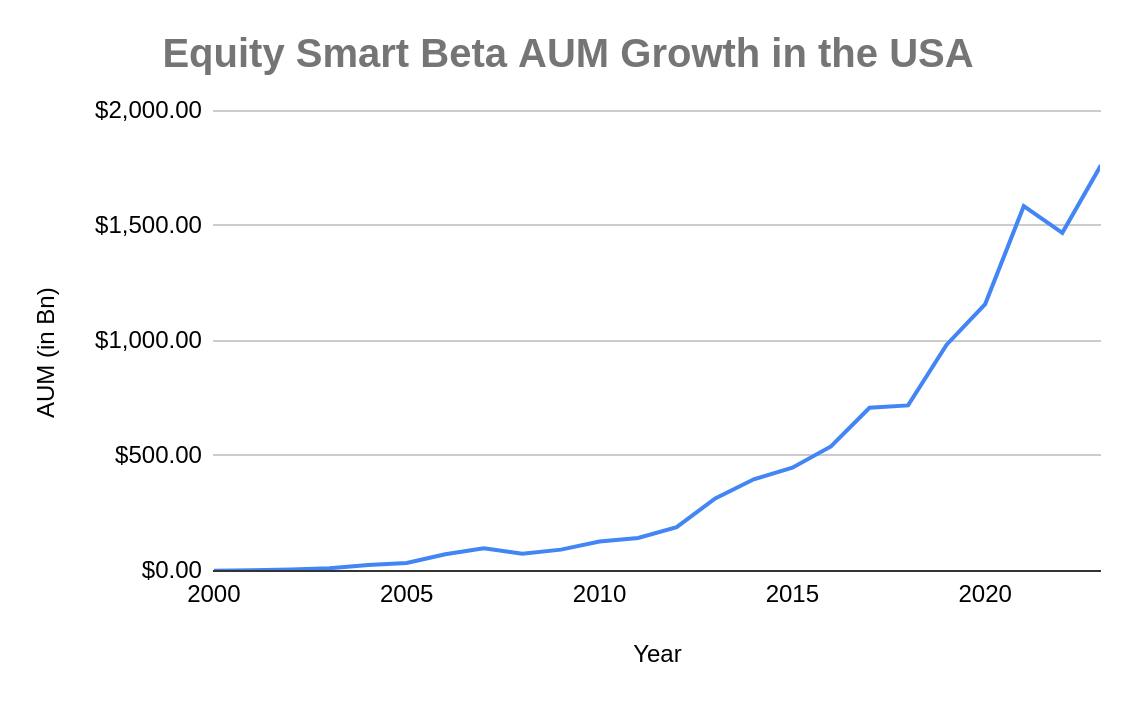

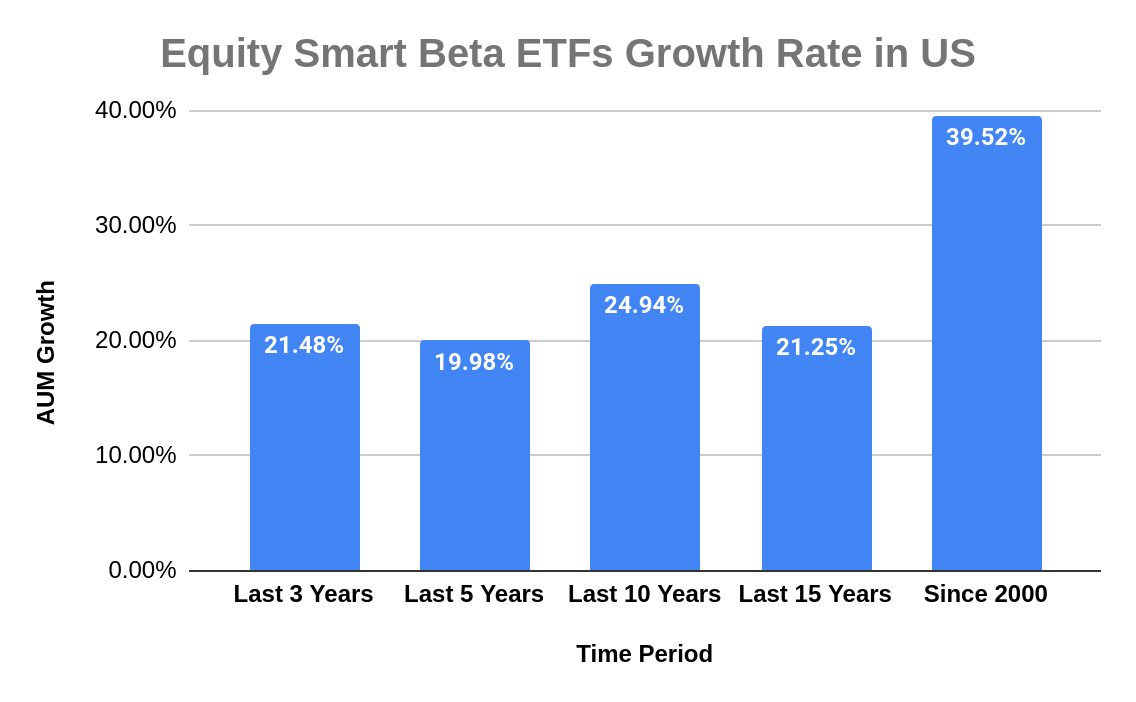

The popularity of Smart Beta investing has surged in recent years, driven by the growing demand for strategies that can potentially outperform traditional indices.

Source: Bloomberg. Data as of 31st December, 2023.

Source: Bloomberg. Data as of 31st December, 2023.

As seen in the above graphs, Smart Beta ETFs have showcased significant growth over the years in the US Markets. With increasing investor awareness and a growing product range, India is well-positioned to experience significant growth in Smart Beta Investing in the coming years.

NJ Smart Beta Platform

NJ Asset Management Company’s philosophy is built on rule-based investing. Henceforth, Smart Beta investing is deeply rooted in NJ AMC’s core values. NJ Asset Management is dedicated to following a disciplined, data-driven rule-based approach.

Rule-based investing emphasizes the essential role of robust IT infrastructure. Keeping this in mind, NJ AMC has introduced a proprietary Smart Beta Platform. This platform encompasses more than 1,200 companies and 20 years of historical data, allowing the researchers to back-test factor-based strategies across a vast universe of stocks. Learn more about the Smart Beta Platform here.

NOTE: Smartbeta is an in-house proprietary module developed by NJ Asset Management Private Limited. The mentioned stock name in the video are only for illustration purposes and should not be constructed as investment recommendations. The returns shown above are only for illustration purposes and are not an indication of returns of any stocks or investment products offered by the AMC.

Conclusion

Smart Beta investing represents a compelling option for investors looking to enhance their portfolios with diversified and rule-based strategies. By focusing on specific factors Smart Beta funds offer a way to achieve improved risk-adjusted returns over time.

Whether an investor is exploring Smart Beta funds in India or considering Smart Beta ETFs, understanding and selecting the right strategy is crucial for aligning with their investment goals. A flexible path for navigating the intricacies of the market, Smart Beta investing offers diversification, enhanced risk-adjusted returns, and increased transparency.

FAQs

1) What is Smart Beta and Factor Investing?

Smart Beta investing combines different aspects of passive and active investing with a rule-based approach, while a factor investing selects stocks based on different factors like value, quality, momentum, etc.

2) What are the key benefits of Smart Beta Investing?

Key benefits of Smart Beta investing include diversification, potential for higher risk-adjusted returns, a disciplined rule-based approach, and greater transparency in portfolio construction.

3) What is a Smart Beta Fund?

A Smart Beta Fund applies Smart Beta strategies by weighting securities based on factors, aiming to outperform traditional market-cap indices while maintaining diversification.

Investors are requested to take advice from their financial/ tax advisor before making an investment decision.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

« Previous Next »

English Video

English Video