Forensic and Governance: Unmasking the Red Flags Quantitatively

Some financial statements can change their appearance, much like a chameleon blending into its surroundings. With a few tweaks or creative metrics, even losses can look less concerning. Take WeWork’s “Community-Adjusted EBITDA” as an example, it was like labelling junk food as healthy. However, forensic analysis is like a predator that uncovers the truth, and strong governance ensures companies can’t hide their flaws forever. Research consistently shows that businesses with solid corporate governance are better managed, more sustainable, and ultimately more valuable.

Understanding Forensic and Governance Analysis

Forensic analysis involves a detailed evaluation of a company’s financial statements to detect red flags that could indicate accounting fraud or irregularities. This step is pivotal in identifying and avoiding potential accounting frauds well in advance, safeguarding investors from sudden losses. The study "Contribution of Forensic Accounting to Corporate Governance" by Bhasin (2013)* underscores the effectiveness of such techniques in identifying financial irregularities and preventing corporate fraud.

Governance analysis focuses on the ethical standards and management practices that shape a company’s direction. A company with strong governance practices ensures transparency, accountability, and alignment of interests between management and shareholders. Research like "The Impact of Corporate Governance on Firm Performance" by Gompers, Ishii, and Metrick (2003) demonstrates how firms with robust governance outperform their peers in profitability and valuation.

The Rise of Forensic & Governance in Investing

Corporate governance and forensic analysis have taken centre stage in the investment world, driven by scandals like Enron in 2001 and Satyam in India. These events exposed how weak oversight and financial manipulation can devastate markets. Enron’s concealment of debt caused shareholder losses of over $74 billion, while Satyam’s inflated profits led to a 70% stock drop in a single day. Such incidents reshaped investment strategies, prioritizing governance and forensic checks.

Financial statements, once trusted, can be manipulated, making deeper scrutiny essential. In India, governance issues like accounting fraud and capital misallocation are widespread, with 40% of BSE 500 companies exiting the index over a decade, as per Marcellus. Research also highlights financial red flags as indicators of manipulation, emphasizing the need for robust analysis.

Strong governance fosters transparency and stability, enabling informed decisions and reducing risks. Forensic analysis adds value by detecting unusual profit margins, cash flow issues, and governance lapses. Red flags like abrupt auditor resignations or policy changes signal deeper problems.

Forensic and governance analysis are now indispensable, helping investors identify risks, address red flags, and make confident, data-driven decisions.

Role of Forensic and Governance Analysis in Factor Investing

Factor investing is fundamentally a data-driven strategy that identifies securities with specific characteristics likely to drive returns. It depends heavily on quantitative data. However, the reliability of these strategies hinges on the quality of the underlying data. The entire investment strategy can collapse if the data is compromised due to poor governance, fraudulent reporting, or manipulation.

This is where forensic and governance analysis becomes indispensable in fortifying factor-based models. While factor investing traditionally leans on quantitative data, forensic and governance analysis often involves qualitative dimensions, such as assessing management integrity, and governance policies, or identifying red flags in corporate behaviour. Bridging this gap between quantitative and qualitative measures is challenging, but it is critical for building robust factor models.

At NJ AMC, we have taken on the challenge of transforming qualitative forensic and governance insights into data-driven inputs for factor investing. By embedding robust forensic and governance analysis into our models, we ensure to filter out companies with potential governance or financial red flags.

NJ AMC’s Forensic & Governance Model: Quantitative Approach

At NJ AMC, our Forensic & Governance Model is built to systematically detect forensic and governance laggards through a quantitative scoring framework. By evaluating key forensic parameters, the model identifies companies with potential financial weaknesses or governance risks. This structured approach helps filter out firms with red flags, ensuring a more robust portfolio while enhancing factor strategies and long-term risk-adjusted returns.

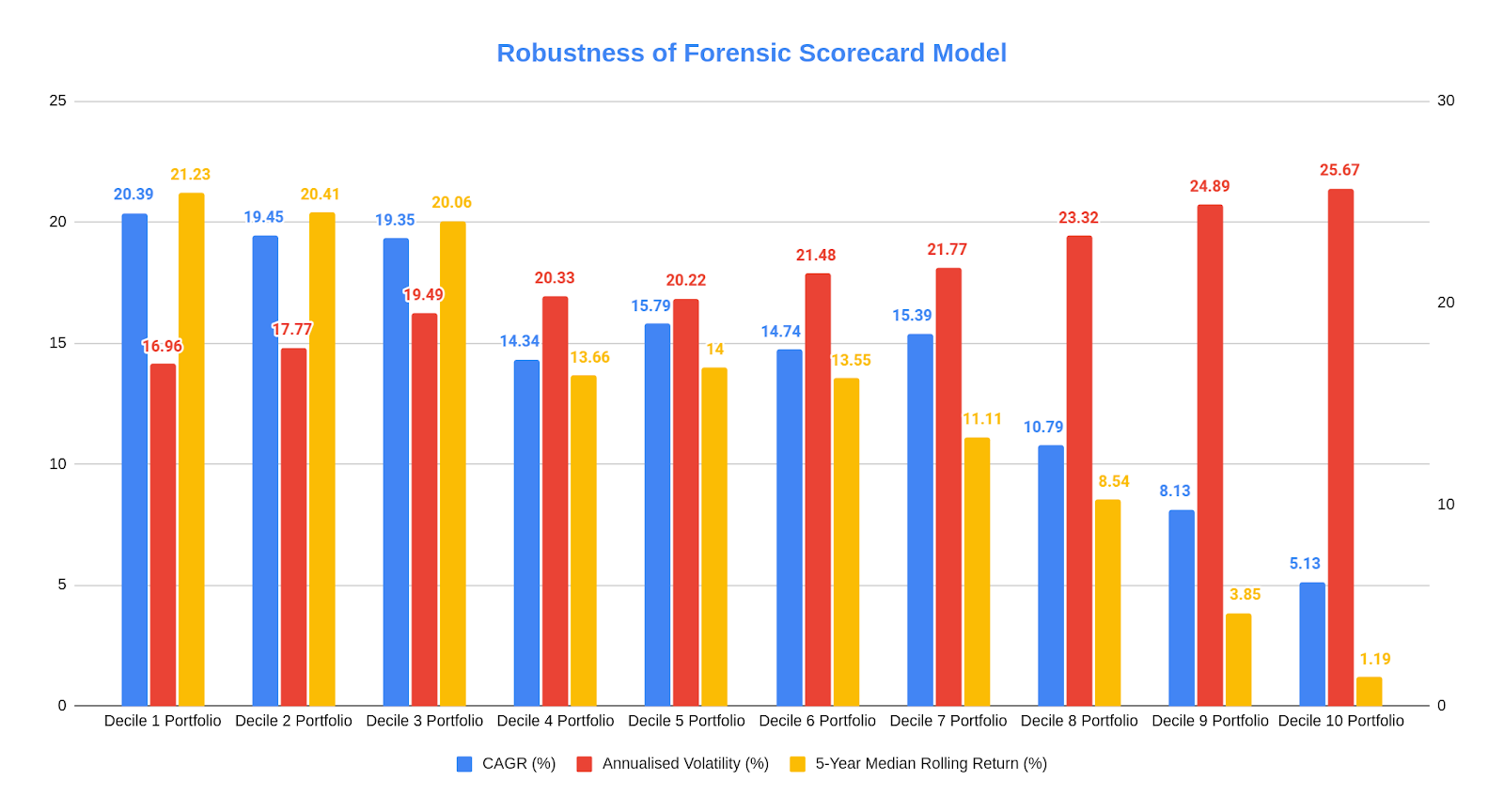

Based on the forensic and governance model, a specific score is assigned to each company in the Nifty 500 index. The companies are then grouped into 10 deciles, with Decile 1 comprising the highest-scoring companies and Decile 10 the lowest. Our portfolio strategies tend to eliminate companies falling the last two deciles based on this proprietary Forensic & Governance Model to safeguard the portfolios from potential corporate shenanigans. This process is repeated for every rebalancing date, and cumulative results of performance parameters are analyzed, as illustrated in the following charts.

Robustness of Forensic & Governance Model

Source: CMIE, NJ’s Smart Beta Platform. Data from September 30, 2006 to December 31, 2024. The portfolios are constructed by ranking all Nifty 500 companies based on their forensic scorecard scores and dividing them into ten deciles. Each decile forms a separate portfolio, with Decile 1 containing the highest-scoring companies and Decile 10 the lowest. Past performance may or may not be sustained in the future and is not an indication of future returns.

The charts above clearly demonstrate a strong correlation between accounting quality and investment performance and risk. Portfolios with higher forensic and governance scores (Deciles 1–3) consistently outperform, delivering higher CAGR with lower volatility and reduced drawdowns. These results highlight the effectiveness of forensic screening in identifying financially sound companies with stronger governance.

Conversely, lower forensic and governance score portfolios (Deciles 8–10) suffer from diminishing returns (CAGR) alongside heightened volatility and severe drawdowns. Their weak 5-year rolling returns further reinforce the risk of investing in companies with governance and financial red flags.

Conclusion

Forensic and governance analysis is not about predicting fraud, it’s about creating a safety net for investors. A robust governance framework ensures that companies operate with integrity, protecting shareholders from financial disasters.

By incorporating forensic checks into factor investing, NJ AMC ensures that investment strategies are built on reliable, high-quality data. In the financial landscape, governance isn’t just a corporate responsibility, it’s the first line of defence against value destruction.

FAQs

1) What is forensic analysis in investing?

Forensic analysis in investing involves examining a company’s financial statements, cash flows, debt levels, and governance practices to identify potential fraud, accounting irregularities, or financial distress before making investment decisions.

2) Why is governance analysis important for investors?

Governance risk analysis helps investors assess the quality of a company’s leadership, transparency, and ethical business practices. Companies with strong governance structures are less likely to engage in fraud or financial misrepresentation, reducing investment risks.

3) How does NJ AMC’s forensic model improve investment decisions?

NJ AMC’s forensic risk management model systematically scores companies based on governance and financial metrics. This helps filter out high-risk firms and optimize investment strategies for better long-term risk-adjusted returns.

Investors are requested to take advice from their financial/ tax advisor before making an investment decision.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

*“Contribution-of-Forensic-Accounting-to-Corporate- ...” Research Gate. n.d. Web. 08 Feb. 2025.

**Guluma, Tolossa Fufa. “The Impact of Corporate Governance Measures on Firm Performance: The Influences of Managerial Overconfidence - Future Business Journal.” SpringerOpen. Springer Berlin Heidelberg, 1 Nov. 2021. Web. 08 Feb. 2025.

« Previous Next »